New to Givio and Charitable Banking™ with your Financial Institution?

If you’ve got questions, we’ve got answers.

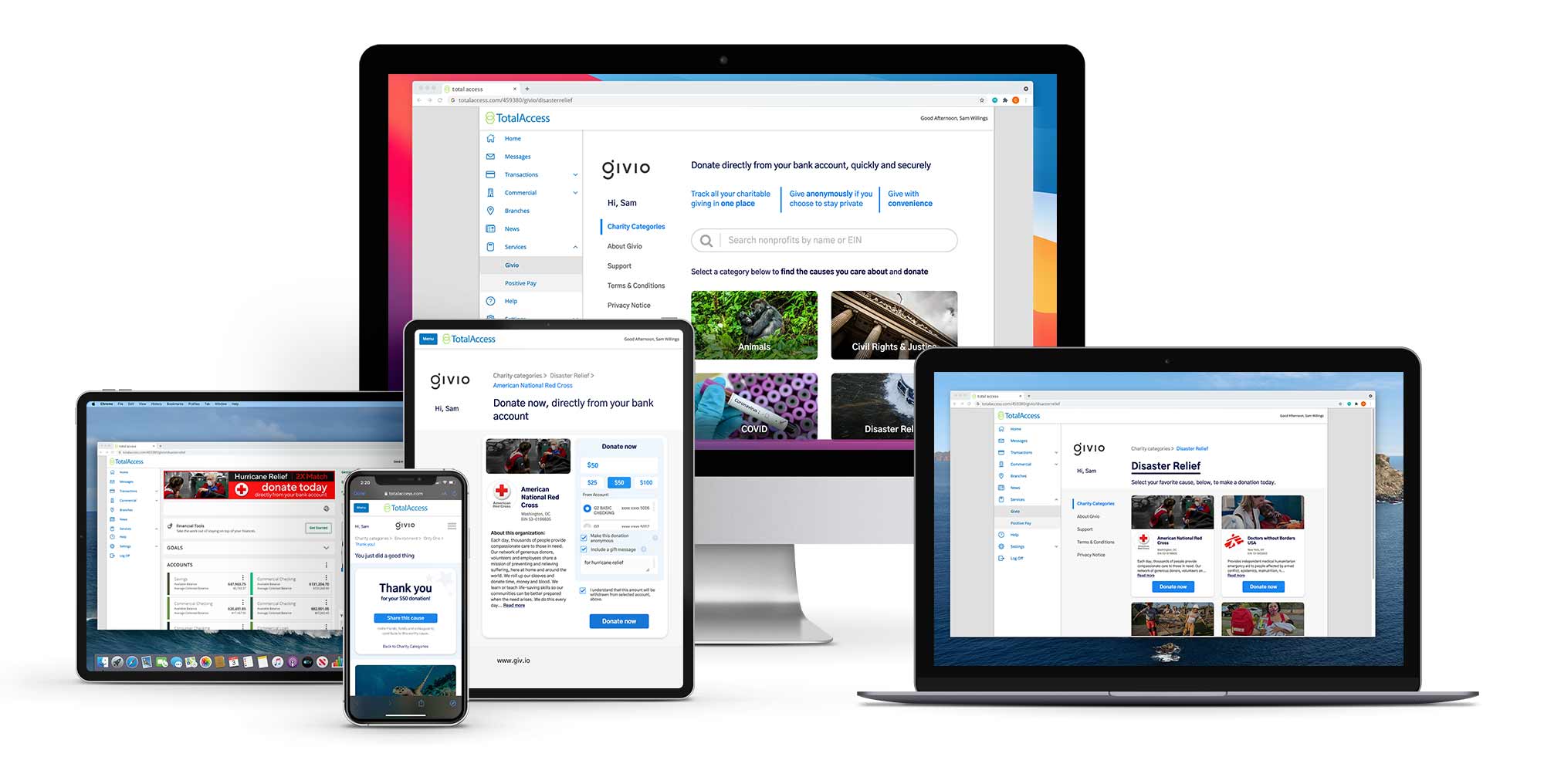

Charitable Banking™ enables Account Holders, like you, to donate to any qualified nonprofit organization in the US, directly from your online bank account … just as easily as you might pay bills online or transfer funds.

So you can make an impact, the moment the inspiration strikes, in just seconds — and track all that goodness in one convenient place.

As an Account Holder of a financial institution offering Givio, there is no need for you to download or sign up for anything to use Givio. All you have to do is log into your online bank account to make (and track) secure charitable donations in seconds. Here’s how:

- Log into your secure online bank account

- Find your Givio link — your bank or credit union may provide a link that says “Donate to Charity”, “Give Back” or “Givio”. If you don’t see the link in the main navigation, check under “Services” or “Marketplace”. Can’t find your link? Let us know!

- On your financial institution’s Givio page, you’ll find a search bar that enables you to search the Givio database to find any of the 1+ million nonprofits approved by the IRS to receive tax-deductible donations. That includes nationally recognized big brand nonprofits as well as the food bank, school or religious organization around the corner from you. In addition to the ability to search for a specific nonprofit, your bank or credit union also presents a group of cause categories that feature nonprofits you may want to discover. And be sure to look out for sponsored fundraisers or matching gift campaigns that allow you to double or triple your impact for important causes in your community.

- Once you find the nonprofit you want to donate to, making a donation directly from your bank account takes just seconds.

- After you’ve made your donation, you’ll receive an email receipt via Givio Charitable Foundation (EIN 47-3955325), with all of the details needed for tracking and for tax purposes including the date, amount, nonprofit details (name, address, EIN) and your gift message if one was written.

- In addition to your email receipt, a complete record of your donation(s) can be found in the Givio portal, as well as in your online banking transaction history.

- To make giving as easy as possible, bookmark your favorite causes for fast access. Just tap on the star icon in the top right corner of your selected nonprofit’s Givio page cover image.

No! If your financial institution provides Givio, your online bank account gives you access.

With Givio, you can donate to every IRS registered 501c3 nonprofit in the U.S. That includes charities, schools, Native American Nations and faith-based organizations.

Givio Charitable Foundation, the 501c3 organization that sponsors Givio’s Donor Advised Fund, checks all nonprofits against the US Treasury Department provided OFAC watch list, prior to donation disbursement. If an organization has been flagged by OFAC, the donor will be contacted to either redirect their donation or to receive a refund. OFAC watch list organizations will not receive disbursements.

Yes. On your selected nonprofit’s Givio page, you’ll see a star in the top right corner of the cover image. Click on that star and you’ll see it change color. That means the nonprofit has been added to your list of favorites for quick access, anytime.

Yes! Givio is an app that lives inside of your financial institution’s Core Banking Software. Whether you’re searching for nonprofits, browsing cause categories or making a donation, everything happens within the secure walls of your bank or credit union’s encrypted digital banking portal. Your banking data never leaves and is always protected. In fact, there has never been a more secure way to make a donation online.

Givio is an integrated part of your financial institution’s secure banking technology platform. Which means that when you make a donation through Givio in your online banking portal, you can choose to make that donation from any of your bank accounts because you’re already inside of the secure and private walls of your financial institution’s digital portal. So making a donation can be done just as easily as paying a bill or sending money to a friend to cover your share of a dinner check.

With Givio, there are no costs to the giver.

And because you’re donating directly from your bank account, there are no credit card processing fees. Givio does charge a small administration fee of not more than 2%*, for the processing of the donation, which helps us keep our lights on. So if you donate $100 to your favorite nonprofit through Givio in your online banking portal, $100 is deducted from your bank account and you receive a tax-receipt for a $100 donation. The nonprofit then receives at least $98.00 of that donation or more. Some financial institutions cover some or all of the fees, in which case your nonprofit may receive up to 100% of the donation.

If you’re not sure if your financial institution covers fees, you can inquire with your financial institution or submit a support ticket to Givio, available in your Givio portal.

*NOTE: This fee was reduced from 4% to 2% on Sept 1, 2023. Team Givio reduced the fee to 2% to further support the act of charitable giving. Prior to Sept 1, 2023, all donations through Givio Charitable Banking, available in select banks in credit unions across the U.S., were charged a 4% transaction fee. Some financial institutions may have covered some or all of these fees.

No! Givio never has access to your private banking information. Your banking information is always secure and protected by your financial institution.

Yes! With Givio, you control what happens to your data. You can choose to share your name and email address with the nonprofit receiving your gift, or maintain your privacy – you decide.

Givio never shares your personal donation information with any third party, including your financial institution. We do not monetize donor data.

Givio believes that respecting the rights and privacy of donors is an important part of building trust and raising funds for the causes we love.

Givio disburses donations to nonprofits, monthly.

All donations are initially received and receipted by Givio Charitable Foundation (GCF) — a 501c3 organization (EIN 47-3955325) that sponsors a Donor Advised Fund – and then are disbursed to the granted nonprofit.*

Here is how the process works

Givio receives donations for nonprofits all over the country. At the beginning of each month, GCF batches all of the donations made to each individual nonprofit to provide one check with an itemized report for efficiency. So rather than sending a $5 check here, and a $100 check there to a specific nonprofit, GCF sends one check accounting for all donations made to that nonprofit in the previous month. Nonprofits receive the itemized list of each donation, amount, time, source (banking app, mobile app or campaign), gift message and identity of the donor (if the donor chose to share their information). A nonprofit can save time processing just one check instead of 10 or 50 or 100. Donor information can be uploaded into communication platforms for easy integration into donor relation operations.

The disbursement process begins on the first of each month and typically takes anywhere from a week to two weeks. During this process, GCF verifies that each nonprofit receiving donations is still in good standing with the IRS and checks the nonprofit against a federal list of organizations sanctioned for suspected drug or terrorist activity. If any red flags are identified, Givio and GCF contact the donor to ask how they would like their funds directed. Once all donations are processed, checks are issued and mailed. Nonprofits are alerted via email of their disbursement and invited to view their secure data file. Instructions to receive donor data are also printed on checks. In most cases, the time from the beginning of the disbursement process to receipt of check is 2 – 4 weeks.

Two examples: (Example 1) A donor makes a gift on the last day of the month. Since the disbursement process begins on the first of the following month, a nonprofit might receive their check 2 – 4 weeks after the donation was made. (Example 2) A donor makes a gift on the first day of the month. On the first day of the following month the disbursement process begins. The nonprofit may receive their donation anytime between 6 – 8 weeks after the donation was made.

Nonprofits have the option to set up ACH payments with Givio Charitable Foundation to expedite the payment process.

Givio and Givio Charitable Foundation will be implementing more free services for nonprofits in 2023 and beyond, aimed at providing donations and donor data ever more quickly and efficiently, while still maintaining donor protections and community integrity.

*Tax receipts are issued to donors by GCF immediately after a donation is made via email, stating that the donation has been received by GCF and will be granted to the nonprofit as directed by the donor. If that donor is a registered mobile app user or a Givio Charitable Banking™ app donor, a complete giving history is always accessible in the app for future reference.

Givio and Givio Charitable Foundation provide services that help the nonprofits achieve their goals, for less.

By making the donation process fast, smooth and reliable, more people are able to successfully make more donations, whenever they are inspired to give. Most nonprofits operated on a shoestring budget. So we have created the technology to streamline the giving process for them and allow them to put the data their donors choose to share with them to good work.

Here are four big benefits to nonprofits

- Simple payments and security. Givio makes it safe and easy for people to give with both the mobile app and our Charitable Banking™ solutions, using convenient payment methods. And when the process of making and tracking donations is a quick and painless one, more people donate, more often.

- Administration cost savings. Givio and GCF streamline administrative processes, like providing donors with immediate acknowledgement and receipting of the donation and batching pools of donations in itemized disbursements. Rather than receiving a $5 check here and a $100 there several times a month, a nonprofit receives one check for processing and one data file that can be uploaded into their communication platforms.

- Expanded donor reach. Givio’s Charitable Banking™ solutions can open up a whole new potential pool of donors for nonprofits — the people who bank with a Givio financial institution. Not only can banks and credit unions promote cause categories, they can feature local nonprofits. Nonprofits can work with banks and credit unions to create fundraising campaigns that can be promoted to all of the financial institutions’ account holders.

- Donor relations. Givio allows donors to choose whether they want to share their identity and contact information, or not. This liberates donors to give even when they don’t want to receive further communications. But it also allows nonprofits to cultivate the relationships with supporters who want to be acknowledged for their role in furthering the mission. Every disbursement issued to granted nonprofits comes with the relevant donor data so the nonprofits can nurture important donor relationships.

No. You decide. If you want to receive updates on the cause you care about, you may want to give them your name and email so they can keep in touch. You might also want to include a gift message or special instructions for your donation. But if you would rather maintain your privacy and remain anonymous, you can do that too.

Sometimes finding the correct nonprofit is harder that it should be. Givio depends on multiple data sources to provide you with the most complete list of nonprofits eligible to receive tax-deductible donations. This includes IRS approved data.

Unfortunately, not every cause a donor supports is actually a nonprofit that is eligible to receive tax-deductible donations. For example, some causes are actually programs of a nonprofit and while you may know the name of the program, you may not know the name of the sponsoring nonprofit. Additionally, political organizations can be nonprofits, but donors cannot make tax-deductible donations to them, which excludes them from our database. And not every tax-exempt organization has up-to-date information on record with the IRS — sometimes a name has been changed for marketing purposes. We do our best, and we will continue to strive to do even better.

If you can’t find your nonprofit, try these steps:

- Spell out the full name. Sometimes your nonprofit may popularly be referred to by an acronym or a shortened name. The name filed with the IRS is the first search result you will find. Sometimes if the IRS registered name is different enough from the acronym or shortened name, you may not see anything similar show in up your search results.

- Check the name, check the spelling. Are you entering the name of a program, for example, but the actual organization name is different? Could the organization be sponsored by a government agency rather than a nonprofit?

- Search by EIN number. The Electronic Identification Number (EIN) is usually the best way to search for a nonprofit. Because there are many nonprofits with similar names, searching by EIN ensures you definitely have found the organization you’re looking for. If the EIN number doesn’t produce results, the nonprofit may not be in our database yet.

If you’re a giver, looking for your favorite nonprofit, fill out this Nonprofit not found form.

If you’re a nonprofit, fill out this Add my nonprofit form and we’ll make sure your nonprofit gets added to our database with a free Givio page after it has been vetted against IRS records.

Just fill out this short form and we will reach out to update your record.

Donations are received and receipted by Givio Charitable Foundation. In most cases, donations and donor reports are disbursed monthly. In some cases, special arrangements are made for disbursements to be made more frequently. When your nonprofit receives your disbursement, you will also receive an invitation to view your secure donor data file, which will include the first name, last name and email address of your donors that opted to share their information, along with a gift message if included and the amount, date/time of the donation, plus the name of the financial institution through which the donation was made.